Establishment & Objective

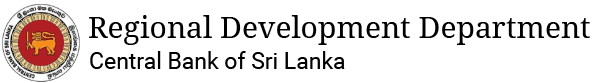

RDD was established in 2002 under the restructuring programme of the Central Bank of Sri Lanka by amalgamating the Development Finance Department and Rural Credit Department with the objective of providing assistance to reduce regional disparity of the country. The strategic orientation of the RDD was officially changed with the enactment of the Central Bank of Sri Lanka Act No.16 of 2023 (CBSL Act) when the Central Bank was entrusted with the statutory duty to promote financial inclusion in Sri Lanka. Accordingly, RDD continues the journey towards a financially inclusive Sri Lanka, with an enhanced focus on introducing much required policy initiatives and behavioral interventions in collaboration with other stakeholders. RDD supports to achieve balanced growth in the country by engaging various regional development activities by increasing access to finance and enhancing financial literacy throughout the country.

In 2020, powers were granted to RDD to monitor and coordinate the activities of regional offices of the Central Bank with a view of strengthening regional office activities in line with the financial inclusion objectives. These regional offices extend Central Bank functions in regions mainly promoting development activities. Currently, the outreach of the RDD is extended through six regional offices established in Matara, Anuradhapura, Matale, Trincomalee, Kilinochchi and Nuwara Eliya.

Functions of RDD

The traditional functions of the RDD were more focused on achieving regional growth through carrying out conventional credit operations which entailed implementing concessionary credit schemes through Participating Financial Institutions (PFIs), as an agent of the Government of Sri Lanka (the Government). However, with the enactment of the CBSL Act, RDD currently focuses on achieving regional development through financial inclusion. Thus, the existing concessionary credit operations of the RDD is expected to terminate in the future on a phase-out basis without any interruption to the ongoing credit operations.

During last few years, scope and the functions of RDD experienced a significant strategic turnaround, where RDD uplifted its focus to promote financial inclusion of Sri Lanka in support of achieving inclusive and stable financial system and a balanced, equitable economic growth, in line with the modern global trends.

Classification of Functions

1 Financial Inclusion

Implementing the Action Plan set under National Financial Inclusion Strategy and Coordinating, Monitoring and Evaluating the progress.

2 Access to Finance

Implementing Credit Schemes at affordable interest rates and Providing Credit Supplementation Services targeting the needy sectors.

3 Financial Literacy

Implementing Financial Literacy and Capacity Building initiatives to promote financial literacy in the society.

4 Regional Office Management

Facilitate, Monitor and coordinate activities of the Regional offices.

5 International Affiliations

Collaborate with international organizations such as AFI, ACSIC and APRACA aiming to improve and share knowledge with peer countries.