The CBSL launched the country’s first ever National Financial Inclusion Strategy (NFIS) in March 2021 with the prime objective of improving the financial inclusiveness of the country by facilitating more accessible, effective, efficient and affordable financial services for each and every individual and enterprise in Sri Lanka. The NFIS is currently in the implementation phase with the collaboration of more than 20 key implementing entities.

The CBSL launched the country’s first ever National Financial Inclusion Strategy (NFIS) in March 2021 with the prime objective of improving the financial inclusiveness of the country by facilitating more accessible, effective, efficient and affordable financial services for each and every individual and enterprise in Sri Lanka. The NFIS is currently in the implementation phase with the collaboration of more than 20 key implementing entities.

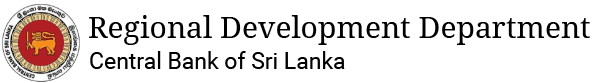

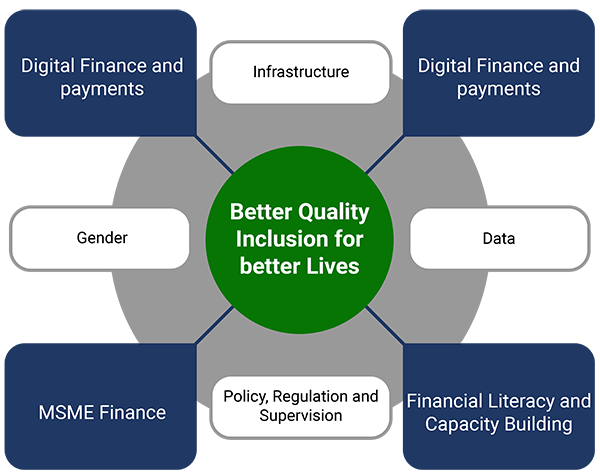

A clear governance structure has been established to oversee implementation, monitoring, and evaluation of the NFIS, where NFIS Secretariat has been set up to ensure coordination across the different implementing entities and to monitor and evaluate the overall progress supporting the governance entities to carry out the relevant responsibilities at different levels. The Action Plan has developed towards achieving the objectives of NFIS in a timely manner, where all stakeholders assigned with time bound actions that fall under their purview. Accordingly, the Action Plan of NFIS encompasses about 80 broad actions spread over the four key pillars of the strategy (Digital Finance and Payments, MSME Finance, Consumer Protection, and Financial Literacy and Capacity Building) and cross-cutting enablers (Data, Infrastructure, and Policy Tools and Enabling Regulatory Environment).

Strategy Framework of NFIS

Governance Structure of NFIS

The National Financial Inclusion Strategy (NFIS) of Sri Lanka is led by the Central Bank of Sri Lanka (CBSL) with the technical and financial assistance of the International Finance Corporation (IFC) a member of the World Bank Group—under the IFC-DFAT Women in Work program. IFC has been a longstanding partner of NFIS since 2018. The basis of the strategy was developed through a national level survey on the level of financial inclusion conducted by CBSL with the assistance of IFC, in 2018.

About International Finance Corporation (IFC)

IFC—a member of the World Bank Group—is the largest global development institution focused on the private sector in emerging markets. IFC work in more than 100 countries, mobilizing capital, expertise, and influence to create markets and opportunities in developing countries. IFC invest in private companies and financial institutions in developing countries, leveraging the power of the private sector to end extreme poverty and boost shared prosperity. For more information, visit www.ifc.org.