- விவரங்கள்

- எழுத்தாளர்: Procons

- பிரிவு: Uncategorised

- படிப்புகள்: 647

During last few years, scope and the functions of Regional Development Department (RDD) of the Central Bank of Sri Lanka (the Central Bank) had a significant strategic turnaround.

Previously, the functions of the RDD were more focused on achieving regional growth through carrying out conventional credit operations which entailed implementing concessionary credit schemes through Participating Financial Institutions (PFIs), as an agent of the Government of Sri Lanka (the Government). In recent past, RDD shifted its focus to promote financial inclusiveness in the country in support of achieving inclusive and stable financial system and balanced equitable economic growth, coping up with the modern global trends.

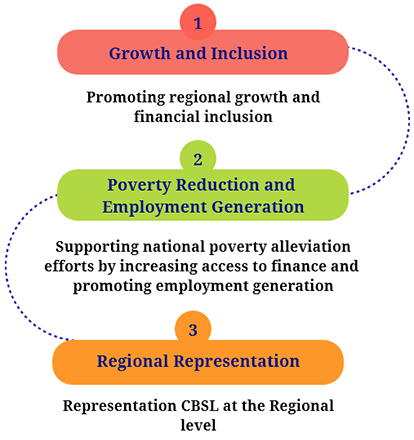

In this light, the present functions of the RDD could be classified as follows;

- Access to Finance: Implementing Concessionary Credit Schemes and Providing Credit Supplementation Services

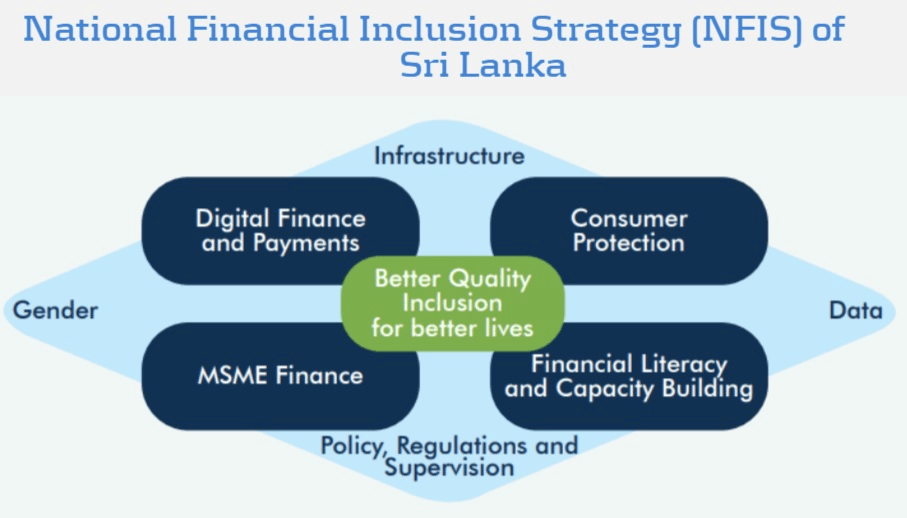

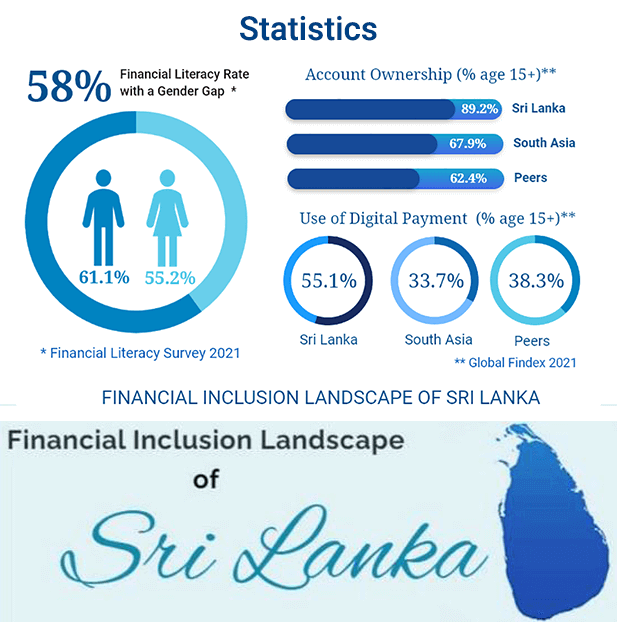

- Financial Inclusion: Monitoring and coordinating the achievements of the Action Plan set under National Financial Inclusion Strategy

- Financial Literacy: Conducting Financial Literacy and Capacity Building Programmes

- International Affiliations: Conducting International Programmes with regard to Financial Inclusion, Credit Supplementation etc. and maintaining relationship with international organizations such as AFI, ACSIC and APRACA.

Conducting awareness and capacity building programs to enhance financial literacy, entrepreneurship development and project management skills of MSMEs and the general public mainly targeting underserved segment of the country in line with the objectives of NFIS. Promoting eco-friendly village environment by transforming selected villages to green villages there by improving healthy living standards and best practices among the community, while focusing on uplifting the livelihood of the underserved people and promoting agricultural exports and market linkage with value chain, while enhancing quality food production for sustainable development. Delivering the services of the CBSL to the regional level through Regional Offices while strengthening the regional development activities via regional forums and conducting field visits to identify regional issues and new business opportunities.

Promoting regional development by coordinating, facilitating, and implementing concessionary credit schemes and delivering credit supplementary services for MSMEs for production oriented economic activities through formal financial sector and generating more employment opportunities in the rural community while reducing regional income disparities. Providing interest subsidies and credit guarantees for the loans provided by PFIs to encourage PFIs to provide credit facilities to vulnerable segments in the country, such as agriculture, livestock, fisheries, and any other income generating activity related to MSMEs including self-employed individuals. Implementing, monitoring, coordinating and evaluating the activities of NFIS of Sri Lanka to increase the country’s financial inclusion.

- விவரங்கள்

- எழுத்தாளர்: Procons

- பிரிவு: Uncategorised

- படிப்புகள்: 1076

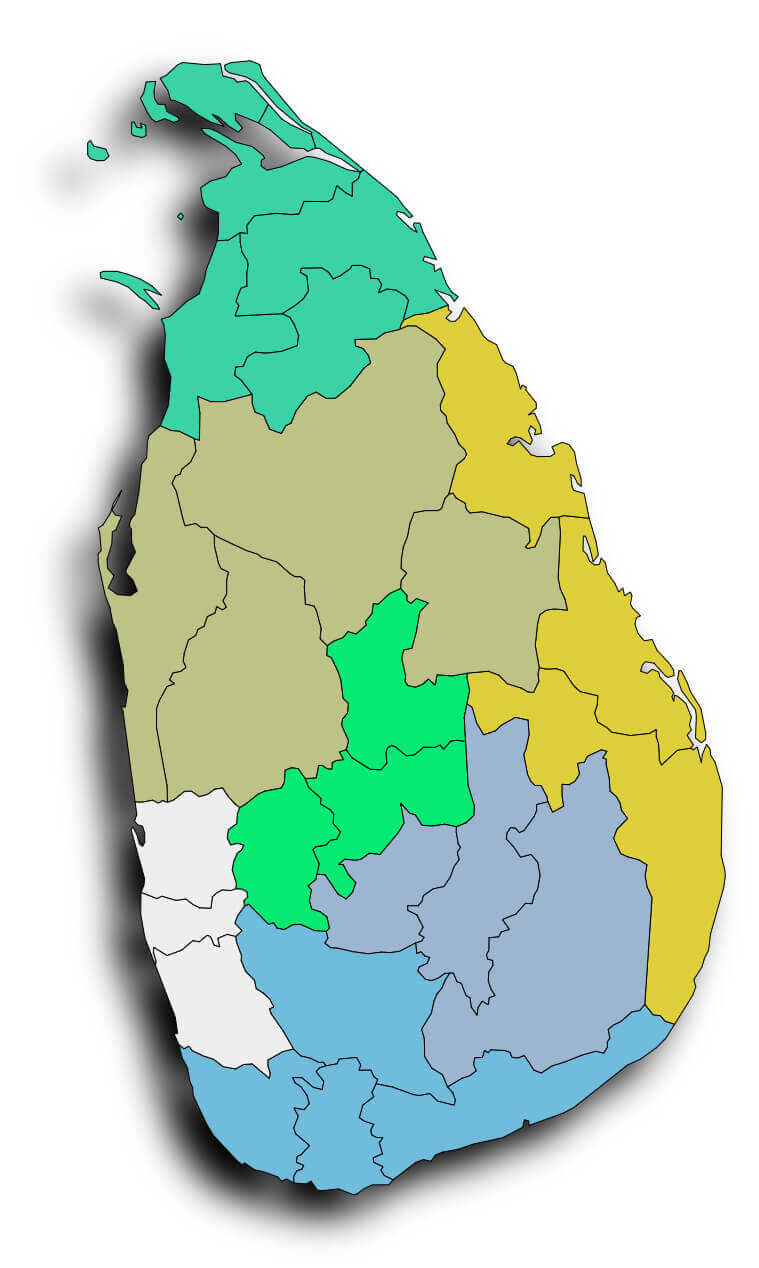

Establishment & Objectives

RDD was established in 2002 under restructuring programme of the central bank by amalgamating the Development Finance Department and Rural Credit Department with the objective of providing assistance to reduce regional disparity of the country. RDD facilitates to promote financial inclusion and to achieve balanced growth in the country by engaging regional development activities by increasing access to finance and enhancing financial literacy throughout the country. Six regional offices established in Matara, Anuradhapura, Matale, Trincomalee, Kilinochchi and Nuwara Eliya are conducting central bank functions in regions mainly promoting development activities. In 2020, powers to monitor and coordinate the activities of regional offices was granted to RDD with a view of strengthening regional office activities in line with the financial inclusion objectives of the central bank.

- விவரங்கள்

- எழுத்தாளர்: Procons

- பிரிவு: Uncategorised

- படிப்புகள்: 1523

|

Lets start a Small and Medium scale businessPublished On: 2015 ISBN: 978- 955-575-311-1 |

|

Kiri Gawa Palanaya Athpotha |

|

Gewaththe Wagawa |

|

Kuda Ha Madya Parimana Wyawasayakayan sadaha Athpotha |

|

Moolya Saaksharathawaya |

|

Kuda Ha Madya Parimana Wyawasaya Sanwardanaya |

|

Kuda Kandayam Kramaya |